Have you ever sat and evaluated the cost that you are paying for your credit? Fundamentally, we know there is a difference between the interest rate given to a person with excellent credit versus someone who needs to improve their credit. Have you ever wondered what that number translates to in hard dollars over the course of a month, year, or even the life of a loan? Well, in this article, you’ll have an opportunity to see and compare the cost of credit.

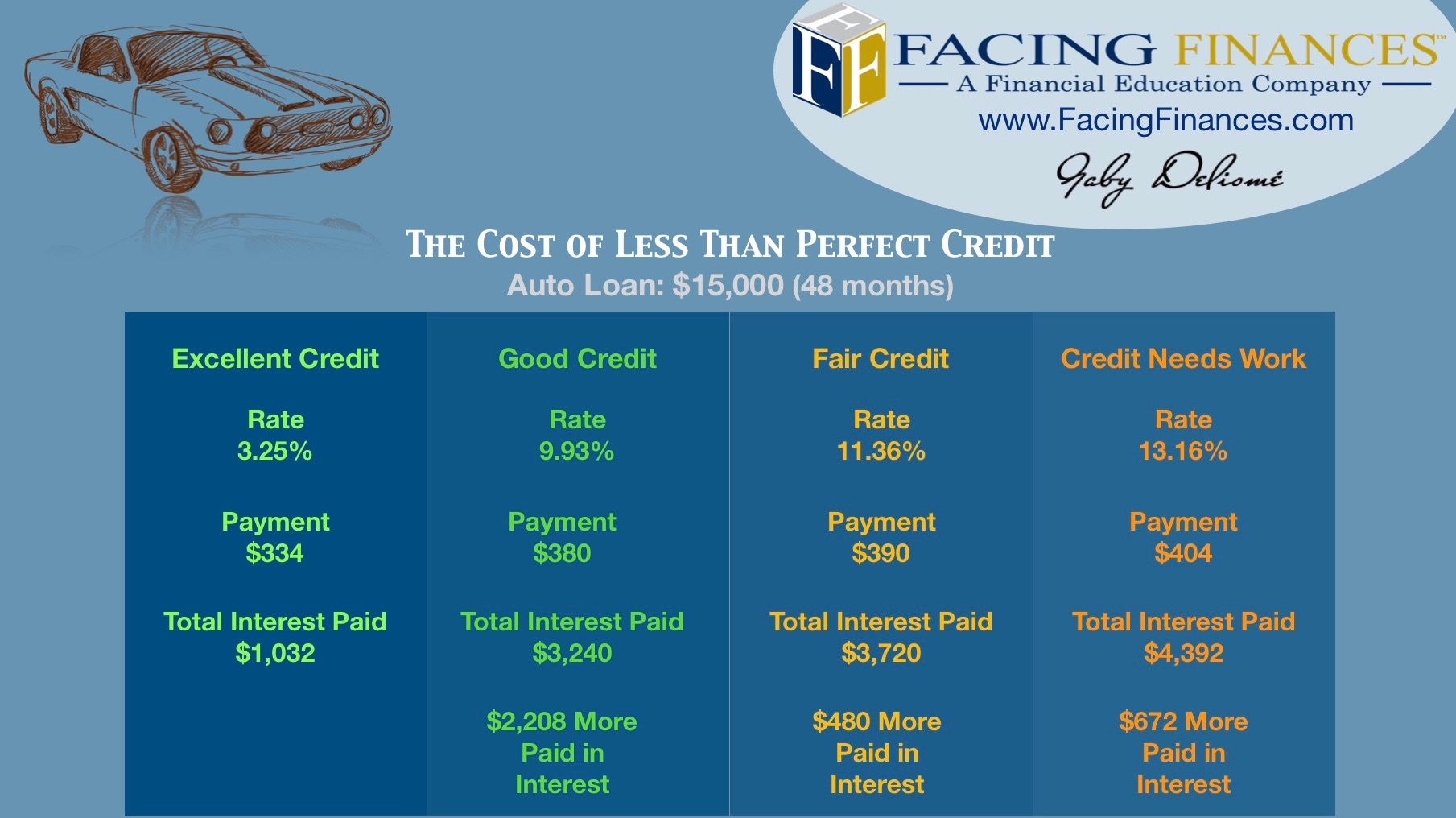

Our credit scores rise and fall on a daily basis, but unless you have some major financial problems within a 30 day window, your score typically falls within the same range. The table below is a depiction of interest rates that will be offered to borrowers with varying credit ratings and the payments associated with said interest rate. Each borrower assumes a 48 month loan for $15,000 to purchase a car.

Over the life of the loan, the borrower with excellent credit will pay $1,032 in interest compared to a whopping $4,392 paid by the borrower who needs to improve his or her credit rating. When you look at the monthly difference in payment from excellent credit to credit needs work that’s $70. Each month, that household has $70 less to save and invest. Over the course of a year, that’s $840 less in hard money that the household has to save and invest. Yes; I said save and invest and not spend.

Equip yourself with the information you need to make the best decision for you and your family. If you are planning to obtain a loan in the future, take the steps to improve your credit and work your way to excellent credit. Start by obtaining one free copy of your credit report at www.AnnualCreditReport.com. This is the only site authorized by federal law to provide free credit reports. Request one report from one of the reporting agencies. Take a look at that report and make notes on what needs to be addressed. Your future self will appreciate the sacrifices you make today.

Disclosure: The interest rates specified are as of July 2018. Please do your research prior to purchasing and entering into any contract.